Overview

Introduction to 3-Statement Modeling Course Overview

The three-statement financial model forms the foundation on which almost all other types of models and analyses are built, and creating one is a crucial skill for many finance professionals. In this course, we will build a three-statement model from scratch and then review and audit it to make sure it’s working properly.

Who Should Take This Course?

This course is designed for beginner-level investment or commercial bankers, beginner-level equity or credit research analysts, corporate development professionals, and financial planning and analysis (FP&A) professionals.

Courses we recommend you take in advance

These prerequisite courses are optional, but we recommend you complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Introduction to 3-Statement Modeling Learning Objectives

- How the three core financial statements link together

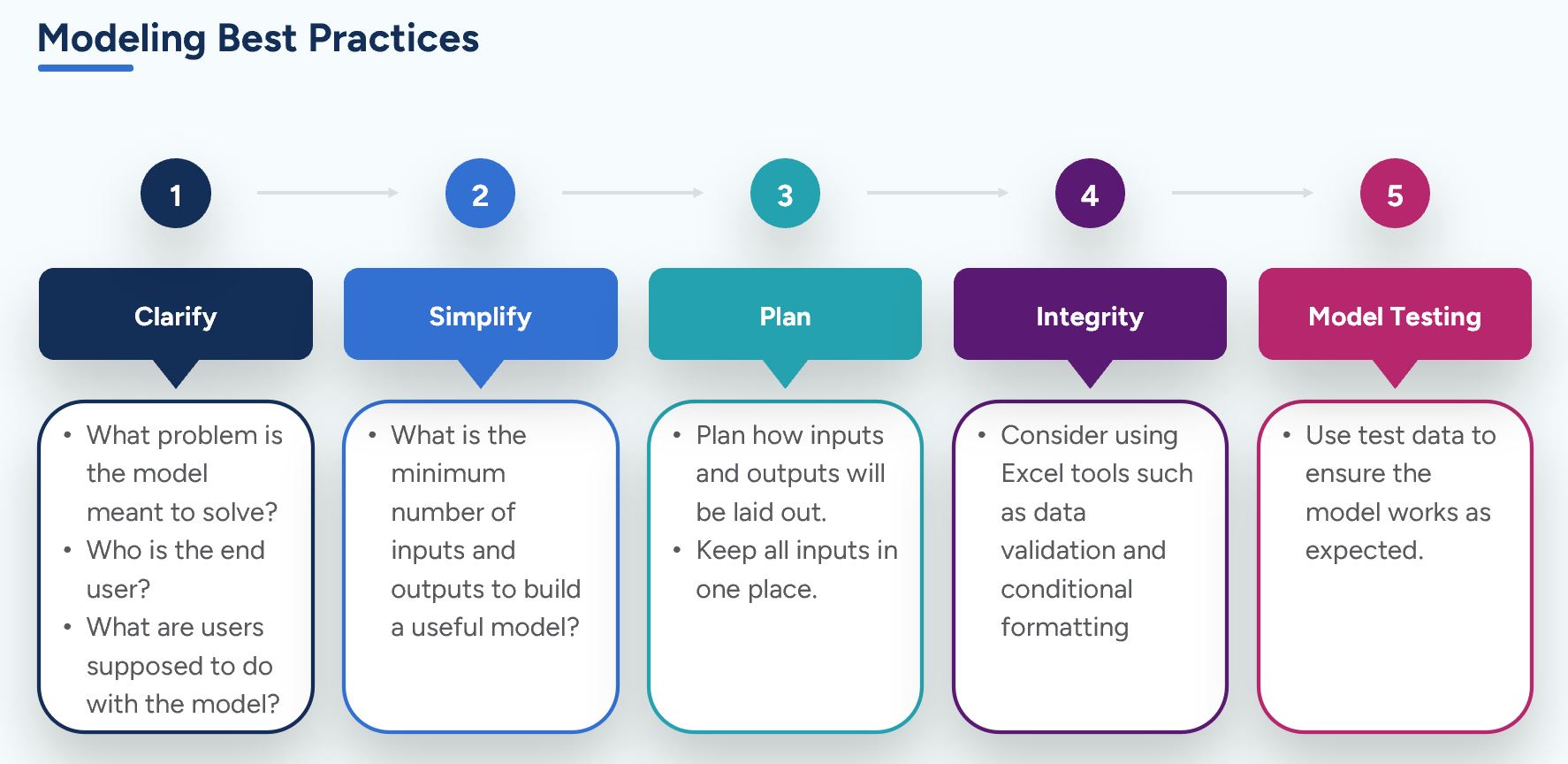

- Financial model-building best practices

- How to build a financial projection model using a company’s historical data and various assumptions about the future performance of the company

- Finding the right balance between a highly complex model and an overly simplistic one

- Thinking about crafting assumptions and various forecasting methods

- How to review your model and audit it for potential errors

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

Level 3

3h

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Model Framework

Forecasting Revenues Down to EBITDA

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Financial Planning & Analysis Professional

- Skills You’ll Gain Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, Data Visualization, Economics, and more

- Great For The FPAP certification focuses on practical, desk-ready skills that are immediately applicable to current FP&A professionals or anyone seeking to land a role in FP&A